Health. Good health is one of the most precious things that we have. And for that we need a good healthcare system. News of the formation of the new Dutch government has brought with it much discussion (once more) about the Dutch healthcare system, or more specifically the financing of the Dutch healthcare system. The minority coalition of D66, the VVD and CDA has announced their intention to raise the cost of the healthcare insurance deductible from €385 to €460. Some opposition parties have already expressed their resistance to the idea (as well as to other proposals set out in the coalition agreement). If you are new to the Dutch healthcare system, you may be wondering what all the fuss about. Read on…

The Premise of the Dutch Healthcare System

Up until 2006, health care in the Netherlands was a public health insurance system. That all changed with the 2006 Health Insurance Act, which essentially merged the public and private sectors.

What does this mean in reality?

It means that a comprehensive base level of health insurance is compulsory for everyone living and working (for more than four months) in the Netherlands. There are a few exceptions but we’ll look at those later.

The premise of the healthcare system is that everyone has access to a good quality of care, in fact, it goes a step further – everyone has access to at least the same basic level of care. And of course, it should be affordable.

So how does the healthcare insurance system work in reality?

Key Dutch Healthcare System Terms

It’s first helpful to understand some key Dutch terms relating to the healthcare system.

Basisverzekering: this is the minimum level of health care, compulsory for everyone, of which the package is determined year by year by the government. It provides cover for emergencies and standard medical needs, such as the GP, home nursing, ER, mental health services, some prescription drugs and access to specialists.

The costs of the basispakket do vary between providers but contributions are not based on age and health. What’s more, healthcare insurers MUST accept all applicants for the basic package (basisverzekering). They do not get to pick and choose who they insure. This is not the case for supplementary insurance (aanvullende verzekering). Which leads us on nicely to….

Aanvullende verzekering: this is supplementary insurance cover and is not compulsory. The insurance providers determine the package contents and the costs. This covers much of that not covered in the basic, compulsory package. Think along the lines of dentistry, glasses and lenses, additional physio sessions and alternative therapies.

Eigen risico: this is a deductible. The government determines how much it is and which healthcare items are exempt from eigen risico.

Who Must Have a Basisverzekering?

The short answer is if you live and work in the Netherlands for more than four months you will need to get yourself a basic health insurance. Unless…

- You are employed by an international company or certain EU institutions – as you are then covered under an alternative healthcare system

- For reasons related to your faith or beliefs you don’t want health insurance

- You are an asylum seeker (then different rules apply)

Healthcare Insurance Companies: Not-for-Profit

There are many health insurers in the Netherlands, all competing for your business. Which is important.

“Competition between healthcare insurers must lead to good affordable care.”

Rijksoverheid.nl

Also important to note is that the overwhelming majority of health insurance providers operate as not-for-profit companies.

The company we were insured with last year did not operate a system whereby you could pay a twelfth (or a variation) of the obligatory deductible each month, putting it into a pot to be used when you actually access health care and have to pay your contribution to the bill. This way you have built up a pot when you get whacked with a bill of hundreds of euros. Anyway, that wasn’t possible because those excess amounts collected by the company would read as a profit on the company’s books.

Not-for-profit. This is the huge difference with the American healthcare system!

What’s the Fuss About Eigen Risico?

The Dutch government introduced eigen risico (deductible) in 2008 (I remember it like it was yesterday). It wasn’t a particularly popular introduction, but by now we have all begrudgingly accepted it as part of life.

Why was it introduced? Eigen risico makes consumers of the Dutch healthcare system more concious of the costs associated with health care. The hope is that if you have to pay a deductible you will ask yourself if accessing the healthcare system is really necessary. The other side of that coin is, of course, the risk that people will avoid using the healthcare system, with all the consequences of this.

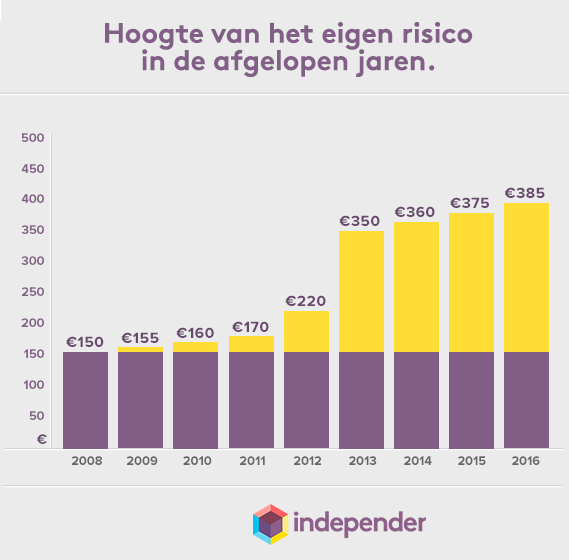

The health care eigen risico began life as €150. There was a significant increase in 2013 and the current amount of €385 was introduced in 2016.

At the beginning of 2025, the then government actually wanted to reduce the eigen risico amount. Plans were abandoned when the then government began doing the maths and realised that we, those of us calling the Netherlands home, would end up paying one way or another. The premiums would go up significantly if eigen risico went down.

This year, 2026, the incoming government, with Rob Jetten at the helm, has declared its intention to increase the eigen risico to €460.

So does this mean our premiums won’t rise then?

Healthcare Insurance Premiums

Well, no, it just means that the increase to premiums won’t be significant.

According to the government, the average monthly premium for the basic package for healthcare insurance in the Netherlands in 2026 is €157 per person. Note that under 18s are covered under a parent or guardian’s scheme (the cost of which is covered by the government).

This is how annual premiums rose between 2006 and 2014.

| Jaar | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|---|---|---|---|

| Gemiddelde premie | €1027,- | €1091,- | €1040,- | €1056,- | €1082,- | €1211,- | €1239,- | €1250,- | €1140,- |

| Procentuele wijziging | +6,2% | -4,7% | +1,5% | +2,5% | +11,9% | +2,3% | +0,9% | -8,8% |

Since then premiums have, unsurprisingly, continued to rise:

“Healthcare insurance is becoming increasingly more expensive. The average monthly premium for the basic insurance rose by €59 between 2015 and 2025. This is €708 on an annual basis.”

So Who Finances the Dutch Healthcare System?

So eigen risico keeps going up, health insurance premiums keep rising and yet the reserves held by the insurers are dwindling. Why?

In short, an aging population. People are living longer and are consequently accessing more healthcare services.

And how is the healthcare system in the Netherlands being financed?

- Insurance premiums (paid over to the providers of health care, in line with pre-negotiated prices)

- Tax revenues (payroll taxes paid by employers)

- Government subsidies

Dutch hospitals are not, in general, government owned. They finance themselves, with the majority of the funding coming from insurers, essentially covering delivered healthcare services.

Emergency Services Funding

Crucial emergency services, however, are funded by the Nederlandse Zorgautoriteit (NZa). This is the healthcare ‘watchdog’ in the Netherlands.

The NBA determines the budgets for ambulance services based on regional demand and capacity. ER departments receive a beschikbaarheidsbijdrage (an availability contribution) from the NZa in order to guarantee the availability of emergency care. Certain trauma centres are kept open with government subsidies. The Huisartsenspoedpost (out of office doctor service), or HAP as it is more commonly known, is kept open by means of special fixed fees paid by the healthcare insurance companies.

Note that if an ambulance is called for you, the costs will come out of your deductible but if you visit the HAP this is exempt from your deductible.

Challenges Facing the Dutch Healthcare System

The challenges facing the Dutch healthcare system are very much the same kind of challenges facing other countries. Namely an aging population, a staffing shortage (for example, it’s hard work finding a GP that will take on new patients these days) and rising costs.

The government focus is on making sure that the Dutch healthcare system remains accessible to all and affordable for all. This means, in reality, healthcare insurance premiums will continue to rise and the government and the healthcare sector will continue to look to innovation, technological advances and sustainability to keep rising costs under control. It also means that the healthcare system, as well as the social care system, will continue to be high on the political agenda and in the headlines for some time to come.

The post The Lowdown on the Dutch Healthcare System appeared first on Turning Dutch.